Risk Management solution in Uk | Basel IV | Financial advisor | Credit & liquidity Risk Management

Uncategorized

Why data is important in financial risk management

BST Consulting Limited

October 27, 2022

What is data?

Data is a compilation of facts and statistics used for research or analysis. These days, it’s most frequently kept in a digital format because of developments in computer systems that can store vast amounts of it.

It is more than simply digits! It is now more than merely a tool for reviewing the past. We can use it to guide decisions and provide us insight into potential outcomes. A data-driven culture is crucial for an organisation to make better decisions confidently.

Financial laws, including Basel II and III, FINREP, COREP, Dodd-Frank, Comprehensive Capital Analysis and Review (CCAR), the European Central Bank’s (ECB) Asset Quality Review (AQR), and stress testing all rely on data as a significant component. Data quality, accuracy, granularity, comprehensive auditability (and lineage), and central analytical data storage are all emphasised by regulators.

The precision and promptness of risk assessment are crucial for making the right decisions. Risk assessment is frequently challenging and occasionally inaccurate due to a lack of appropriate data, inaccurate processing by risk assessors, and a time-consuming review procedure. Fortunately, you may reduce these risks, expedite the process, and improve its accuracy.

Let’s examine more closely how data usage may help financial institutions.

Better Decision Making

A thorough risk management plan must understand all the relevant factors involved. The response to crises will differ from your routine operational risks, but keeping track of frequent potential issues is a step in the right direction.

The role of data and its analysis in risk assessment, especially credit risk assessment and management, is significantly vital. Data Analytics will ensure that financial institutions have all the information needed about customers. These customers include individuals, organisations, sovereigns and more that they need to do business with.

The risks associated with lending cannot, in reality, be eliminated. No matter how high the borrower’s credit score is, there is always a chance that the loan won’t be repaid due to various factors. However, data analytics may assist in making decisions that effectively manage risk and accurately forecast outcomes.

You need the ideal data to gather pertinent, credible, and comprehensive information. When you analyse your it, you’ll get the knowledge you need to manage the business, like what steps to take next or if your strategy succeeded. Your ability to base your subsequent decisions on more information increases with the amount of data you store.

Automation and Optimisation of Processes

Data power AI technologies like chatbots, and as more and more of it is examined, the intelligence of these products grows. Chatbots can better spot trends and provide better answers thanks to data analysis. Chatbots can act as first-line customer care representatives, allowing businesses to handle more consumers with fewer staff members.

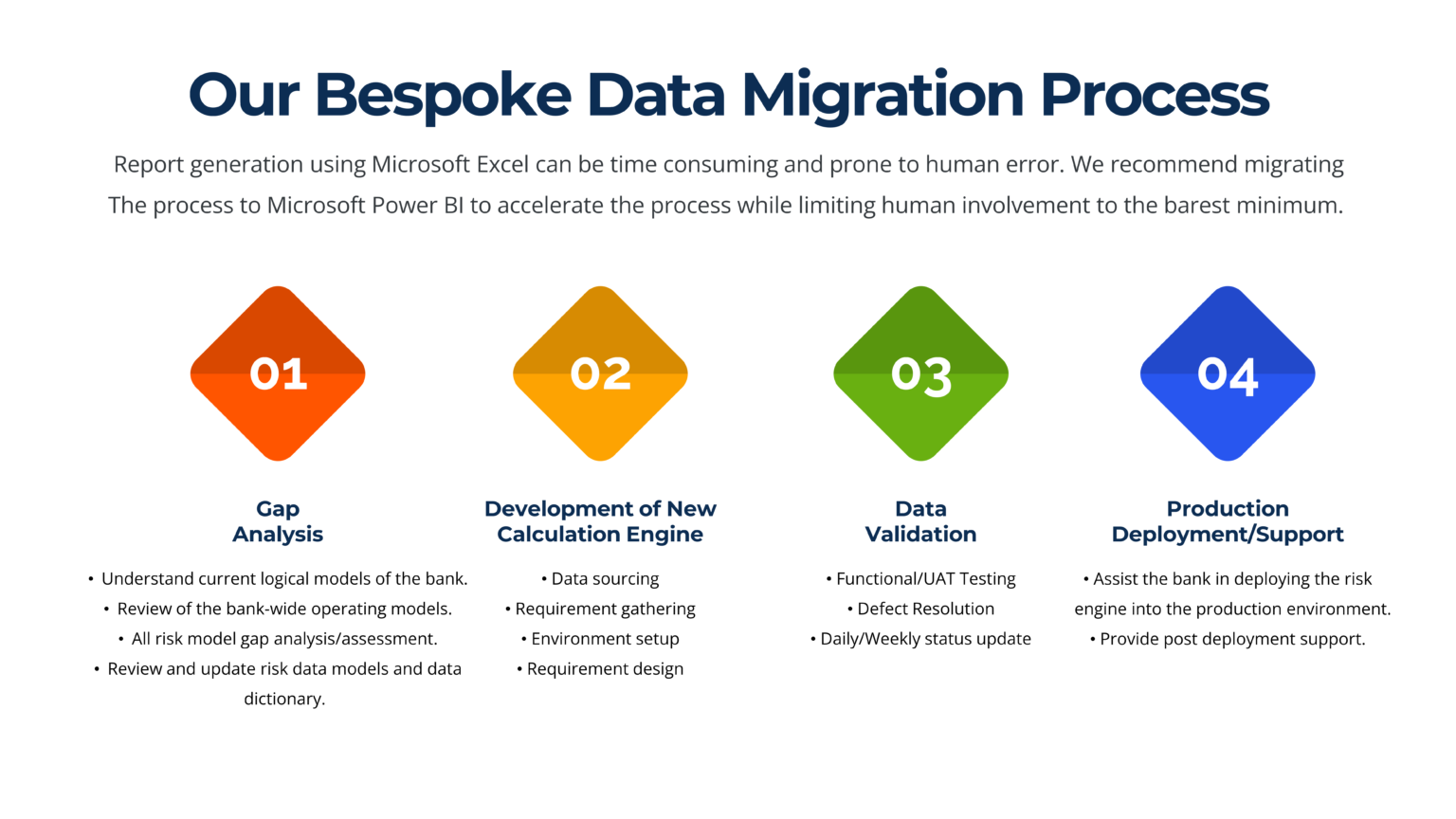

Data is also used to generate daily, weekly, monthly and yearly reports submitted to banking governing authorities (a good example is the Central Bank). The report generation process is accelerated when data is properly used, analysed and visualised using tools like Microsoft Power BI.

At BST Consulting Limited, we have helped some prestigious banks improve their process of generating relevant reports from taking about five (5) working days to just around 1 hour. This is only possible through data science/analytics.

Banks and other financial organisations can become more responsible lenders using practical data analysis to detect risks better. Data Science has gotten much better at seeing patterns. This capability may comb through enormous volumes of data to spot trends and other elements relevant to risk assessment.

Banks can increase the ease with which their clients can get pre-approval for certain services by automating this process. This will encourage more consumers to accept offers and use services without adding to the workload of the workforce. Automation and data science can put more important information at decision-makers’ fingertips. This will ensure that better judgments can be made, even if they don’t permanently eliminate the necessity for human engagement in decision-making.

Identify Risk Factors

Data and its analysis play a crucial role in helping financial authorities and institutions identify fraud. As more people live online, we leave digital footprints that may be found online. We must take every precaution to lower the risk of fraud since criminals can utilise these footprints in several nefarious ways.

Data may enable a scientist to see trends and patterns regarding fraud. This is why it plays a significant role in this process. In rare cases, it might even point law enforcement officials in the direction of fraudsters.

Data helps banks and financial institutions identify risks and threats during audits to prevent unnecessary disputes with potential stakeholders, partners, or suppliers. However, it can be challenging to detect when something isn’t working as it should if data isn’t being stored. Management can spot indications of fraud thanks to a comprehensive database. If something goes wrong with a client, an organisation can easily demonstrate that it took steps to prevent the incident. This can help preserve the brand’s reputation.

Customer Personalisations

The retail sector will always lead all other industries in terms of better customer experience and product personalisation. Regarding customer experience and personalisation, banks and other financial industries also borrow cues from the retail sector.

Retailers are among the sectors that have mastered techniques like product recommendations based on past purchases and offer creation based on geography information and seasonal sales.

Many bank clients desire and anticipate receiving such services from their banks. According to a poll conducted by Accenture Financial Services, 63% of consumers are okay with sharing their personal information with banks. This will enable them to receive tailored offers regarding goods and services that are relevant to them. In addition, 40% of customers want services to be more personalised.

Banks can offer personalised customer services swiftly with effective data gathering and analysis by employing analytical solutions.

Conclusion

Data has been a significant driver of development for numerous businesses over the past few decades, but it has particular significance for the financial sector. It now plays a significant role in every sector of the economy. This includes the financial sector, dramatically impacting how we live our lives. Businesses are spending a ton of money on analytics and analytical tools to enhance business analysis processes, including banks, credit unions, investment management, and many more. However, we need to utilise data science even more proactively when it comes to our finances to progress in the financial services sector and safeguard our interests.